Historically, the packaging market was characterized by single-use packages and minimal raw material regulation. This has given way to a new era, which drives towards a more sustainable value stream, from material sourcing to waste collection.

As companies embrace this transformative norm, more and more stakeholders in the value chain – from raw material suppliers to packaging converters, from customer-facing brands to local and international governing bodies – have started to synchronize their efforts and engage in comprehensive collaboration.

Investor appetite for companies at the forefront of this trend is increasing more broadly, while at the same time redefining environmental, social and governance (ESG)-driven investing. Mergers and acquisitions (M&A) continues to serve as a tool to accelerate strategic acquirers’ road to sustainability, encouraging both buyers and sellers to share in eco-conscious and responsible behavior.

Drivers of Sustainability

Several macro factors, including an increasingly eco-conscious consumer, regulatory pressure and incentives and a greater emphasis on corporate social responsibility are fueling the sustainability movement.

According to a recent study done by McKinsey & Co., 43% of all consumers view the sustainability of their products’ packaging as a crucial part of their buying decision. These trends reflect a growing global interest in sustainable packaging solutions, focused more specifically on the food, beauty, personal care and e-commerce segments, with less emphasis on non-consumer-facing markets such as manufacturing and industrials.

Consumer sentiment is a major driver in this transformation. Historically, product price point has been the most significant decision factor for consumers. Now, consumers question a product’s sustainability when weighing the decision to purchase.

We’ve seen a meaningful increase in consumers’ willingness to “pay up” for environmentally friendly products, such as tree-free paper like sugarcane, particularly across younger demographics. This sentiment is reflected in their purchasing decisions, indicating a shift toward sustainability-conscious consumer behavior.

As consumer preferences shift towards a future with increased emphasis on environmental responsibility, we expect the packaging industry to adapt to stay relevant and mitigate its ecological footprint. The goal is packaging that is not only effective, efficient and safe but also circular, aligning with these new principles of sustainability.

Case Studies in Sustainable Packaging

Several packaging companies are leading the forefront in sustainability either through innovative materials or emphasis on recyclability:

| WinCup (Atar Capital) – Phade Straws

Phade is an innovative line of home compostable, industrial compostable and marine biodegradable food service disposables. The inaugural invention, the phade straw, is a sustainability-focused product made with PHA, a material derived from fermented canola oil, that performs like a traditional straw but doesn’t get soggy or have undesirable chemicals like many paper straws do. Phade has earned over 11 certifications from BPI and TUV, the global leaders in this field. WinCup urges all of us to responsibly compost its phade products. Clearly Clean (Blue Sage Capital) – Recyclable Food Trays Clearly Clean’s recyclable food trays serve as a practical alternative to increasingly regulated foam trays. Made with 100% recyclable PET resins, the trays are three times stronger than Styrofoam with smooth edges to mitigate leaks. Trays are FDA-compliant with proprietary rolled edges for overwrap and vacuum skin packaging films. The packaging market has shown impressive receptibility to this sustainable alternative – Clearly Clean was awarded the 2019 AmeriStar Package Award for Refrigerated Foods and the DuPont Award for Packaging Innovation. |

Navigating Global Regulation and Consumer Preferences

The call for sustainable packaging is echoed by governments worldwide, leading to several new regulatory initiatives pushing for change.

For example, the EU Plastics Strategy mandates that all plastic packaging be reusable or recyclable by 2030, while Australia’s legislation has banned single-use plastics since March 2021. In a similar vein, four U.S. states (Oregon, California, Colorado and Maine) have all passed “extended producer responsibility” legislation for plastic packaging, with additional regulation proposed in the near term.

These rules historically target “hard to recycle” materials. California’s Assembly Bill 792, more commonly referred to as the “Bottle Bill” requires bottle packaging to be made with 15% recycled content by 2022, and eventually 50% recycled content by 2030.

Similar pressures are being exerted in the UK and China. Compliance with these rules and regulations are not only necessary, but challenging, giving those companies that quickly adapt an advantage with eco-conscious consumers.

The reduction, or complete ban, on scrutinized materials has been a primary focus for government bodies. Potential concerns with plastics vary – for example, their single-use nature or the potential harm they may have when in contact with end users (e.g., per- and polyfluoroalkyl substances (PFAS)).

It’s important for companies to consider investing in alternative materials, such as polybutylene adipate terephthalate (PBAT), polylactic acid (PLA) or cellulose packaging, to stay ahead of these trends. Servous, a manufacturer of corn starch-based food trays, bags and containers, is a testament to the success alternative materials can bring. The company uses eco-friendly materials to produce PLA packaging throughout the consumer space, paving the way for similar brands to follow suit.

Empowering Sustainability: Smart Labels, Data Analytics and the Packaging Industry

To keep up with these trends, Lincoln International has seen companies leverage innovative, technology-driven solutions.

As touched on in previous perspectives, smart labels, data analytics and other solutions are emerging as powerful tools that hold the potential to revolutionize the industry’s approach to sustainability. By investigating how smart labels and data analytics can help the packaging industry become more sustainable, businesses can foster innovation, efficiency and a reduced environmental footprint.

Smart labels, often equipped with technologies like radio frequency identification (RFID) or quick response (QR) codes, serve as gateways to a wealth of information about products and their packaging. These labels empower consumers with the ability to access detailed data on a product’s origin, ingredients and disposal instructions.

Leveraging this technology, companies eliminate the need for additional packaging with this information while also encouraging customers to access labels via technology.

For example, Uniqlo has begun to implement the use of RFID chips within their product tags to better track their inventories, as well as expedite the checkout process for their customers. This initiative has allowed the company to have more control over the inventories within each store, ultimately giving them more control over their supply chain.

Data analytics enable the packaging industry to embrace precision in its operations. By analyzing consumption patterns and customer preferences, companies can adjust packaging sizes and materials to align with actual demand.

This reduction in excess packaging not only conserves resources but also decreases the carbon footprint associated with transportation and storage. As data-driven decisions lead to resource-efficient packaging solutions, the industry moves closer to a circular economy model.

The convergence of smart labels, data analytics and technology is heralding a paradigm shift in the packaging industry. These innovations are transforming packaging from a passive container into an interactive platform for information, collaboration and sustainability.

As smart labels guide consumers towards responsible choices and data analytics empower businesses to make informed decisions, the packaging industry is poised to become a trailblazer in environmental stewardship.

Driving Sustainable Packaging Solutions Through Mergers and Acquisitions

As sustainability becomes a core pillar in the packaging landscape, it is imperative that companies consider M&A as a tool to acquire more eco-conscious solutions and responsible practices.

Whether it’s through the acquisition of environmentally friendly technologies, the sharing of research and development capabilities, or the consolidation of supply chains, M&A can facilitate the rapid adoption of sustainable practices.

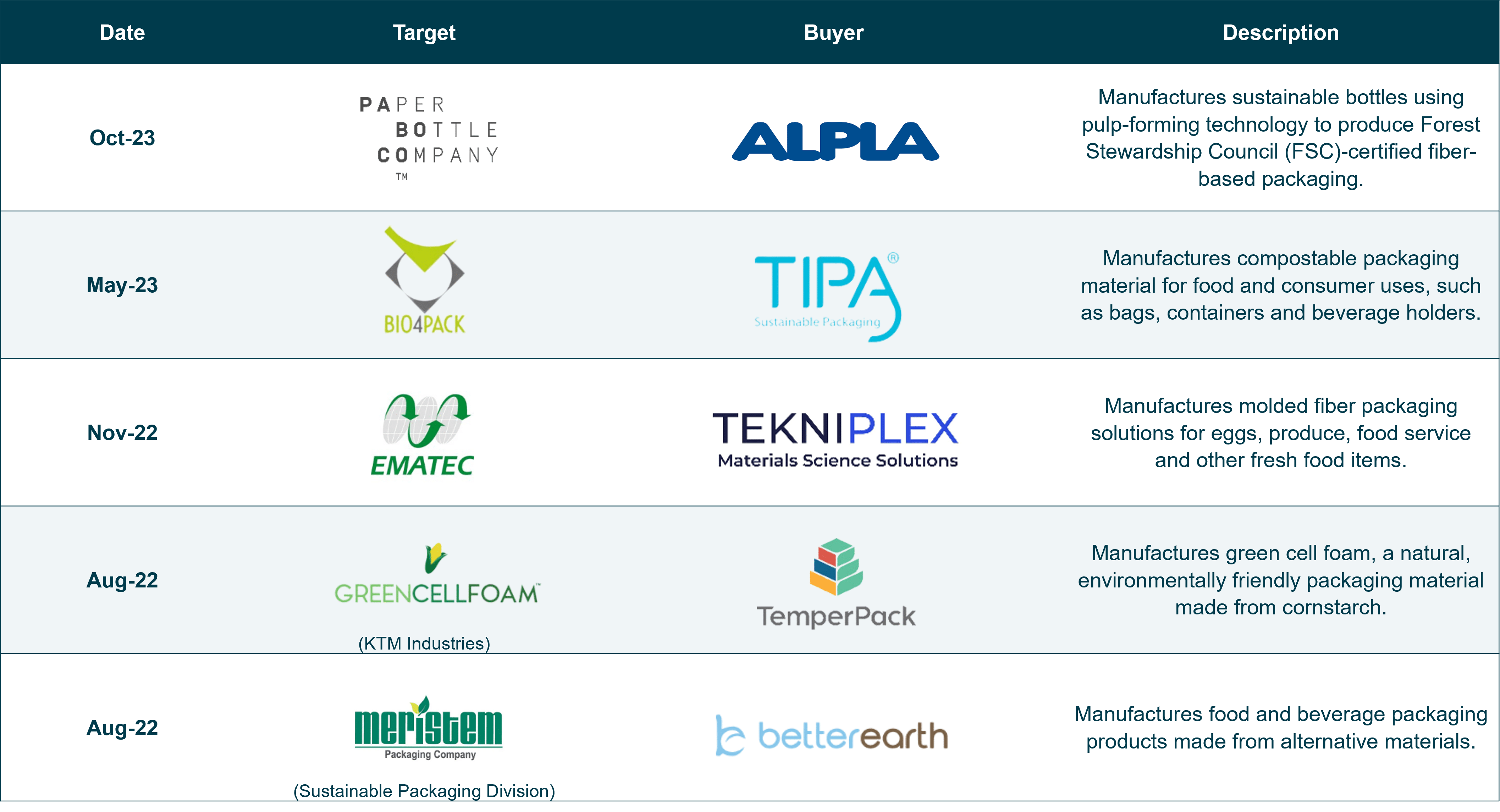

Additionally, the broader scale and market share stemming from M&A provides companies with the leverage to negotiate and implement sustainability-focused initiatives more effectively. For these reasons, both strategic and financial investors are keen to invest in companies with a sustainability angle, as made clear in the below table highlighting recent transactions in the sustainable packaging space.

We recently released an article on the growing interest of private equity funds in recycling infrastructure. Our outlook on the future of sustainable packaging remains optimistic as more and more companies adopt eco-friendly practices as influenced by consumers and regulatory bodies.

Contributors

I am a rigorous advocate for my clients with a hands-on, communicative approach and provide industry and financial expertise to deliver external perspective and outstanding results.

Luke Webb

Managing Director & U.S. Co-head of Business Services

ChicagoMeet Professionals with Complementary Expertise in Packaging

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director & Head of Switzerland

Zurich

I take an active role in every stage of the transaction process in order to achieve the goals of my clients.

Iván Marina

Managing Director & Head of Spain

Madrid

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

Paris

I am a rigorous advocate for my clients with a hands-on, communicative approach and provide industry and financial expertise to deliver external perspective and outstanding results.

Luke Webb

Managing Director & U.S. Co-head of Business Services

ChicagoRelated Perspectives

Recent Transactions in Packaging

Sustainability in Focus for Packaging M&A

The packaging industry faces a paradigm shift amidst a growing public conversation on climate change and, as a result, the concerted endeavors of governments worldwide to regulate single-use packaging and… Read More

Bloomberg TV | Lincoln International CEO Gives 2024 Outlook

Originally posted by Bloomberg on December 27, 2023. Rob Brown, CEO of Lincoln International, discusses his 2024 mergers and acquisitions market predictions, including an increasing focus from Western companies on… Read More

The Loadstar | When Consolidation Pressure Meets a Cautious Outlook: M&A in 2024

Originally posted by The Loadstar on December 12, 2023. In 2023, global growth was limited by escalating geopolitical conflicts and central bank actions to combat inflation and soaring energy costs,… Read More

Women’s Wear Daily | What to Expect from Beauty M&A in 2024

Originally posted by Women’s Wear Daily on December 8, 2023. Many expect beauty brands to come to market in 2024, but the exact timing will be contingent on several dynamics.… Read More

Five Key Insights from Agritechnica Trade Fair – A Full House in Hanover

Record crowds in Germany and exhibit halls full of new products suggest the agricultural equipment industry has a bright future Lincoln International’s industrials team was well represented at this year’s… Read More

Best Practices for Preparing a Corporate Carve Out

While macroeconomic challenges and rising interest rates correlate to a slowdown in mergers and acquisitions, corporate carve out transactions often see significant upticks during times of economic uncertainty as businesses… Read More

Transport Topics | Mergers and Acquisitions Market Begins to Accelerate

Originally posted by Transport Topics on November 13, 2023. Mergers and acquisitions (M&A) activity is anticipated to rise, given the stabilization of economic challenges and the adaptation of industry players… Read More

Cybersecurity Report: Q3 2023

Q3 2023 cybersecurity M&A and investment deal volumes increased from the previous quarter for the first time in 2023, while cyber public share price performance improved as valuations and profit… Read More

Recycled Plastics Market Draws Investor Attention

Not a day goes by without the announcement of a new regulatory, industrial, or commercial initiative relating to the European circular economy, making it a major topic for corporates and… Read More

Corporate Carve Outs: A Strategic Growth Tool for Turbulent Times

When challenges arise in the economic environment, businesses become much less interested in discretionary acquisitions—particularly larger deals or at higher multiples, creating a need for dealmaking alternatives. The result is… Read More

In Japan, M&A Set To Climb Amidst Low Rates And Regulatory Changes

Japan is a country with advanced and independent sensibilities in terms of its traditions, aesthetics and, especially, how it does business – demonstrable in a 14 percent increase in mergers… Read More

Toby Bottomley

Toby provides mergers and acquisitions advisory services to clients in the business services industry, with a focus on the professional services and testing, inspection and certification sectors. He has extensive… Read More

pemacom | Outlook for the German M&A Market in 2023

Originally published by pemacom on September, 19, 2023. 1. Challenging Economic Environment Following a weak second half of 2022, the number of M&A deals will continue to decline in… Read More

Takuto Yamada

Takuto provides mergers and acquisitions advisory services to Japanese and international companies across sectors. Takuto has more than a decade of experience delivering distinctive solutions to clients for intricate scenarios,… Read More

Packaging Quarterly Review Q3 2023

We anticipate deal flow will start to open up in Q4, with more notable activity starting in 2024 as previously unfavorable macroeconomic factors begin to re-align with a more fruitful… Read More

Thilo Schomberg

Thilo provides mergers and acquisitions advisory services to private equity firms, small and medium-sized enterprises and large-cap multinational corporations in the industrials industry, with a focus on automotive and mobility… Read More

Lincoln International adds Julian Moore as Managing Director in London

Lincoln International, a global investment banking advisory firm, is pleased to announce that Julian Moore has joined as a Managing Director in the firm’s Technology, Media & Telecom (TMT) Group in London.… Read More

Affärsvärlden | Increasingly Lower Activity in the M&A Market – But Advisers See Glimmers of Light

Originally posted by Affärsvärlden on October 6, 2023. While the total number of acquisitions fell in Sweden during the third quarter, transaction value increased, and new legislation and other market… Read More

Julian Moore

Julian provides mergers and acquisitions advisory services to private equity firms, founders and public corporations in the business-to-business (B2B) technology industry, with a focus on data and analytics, artificial intelligence,… Read More

Cybersecurity Report: Q2 2023

Consecutive quarterly sector mergers and acquisitions (M&A) deal activity rose in Q2 2023 to 54 cybersecurity transactions, from 49 in Q1 2023. Q2 M&A volume of $2.4 billion was roughly… Read More

HealthInvestor | CMA Launches Review of Vet Sector

Originally posted by HealthInvestor on September 7, 2023. The Competition and Markets Authority (CMA) has begun reviewing UK veterinary services to uncover how well the market is working for pet… Read More

Andrew McDonald

Andrew provides mergers and acquisitions advisory services to clients in the consumer industry. He has extensive experience working alongside private equity firms, entrepreneurs and business owners on sell-side and capital… Read More

Ferdinand von Marx

Ferdinand provides mergers and acquisitions (M&A) advisory services to clients in the business services and industrials sectors. He works closely with buyers and sellers across the globe on domestic and… Read More

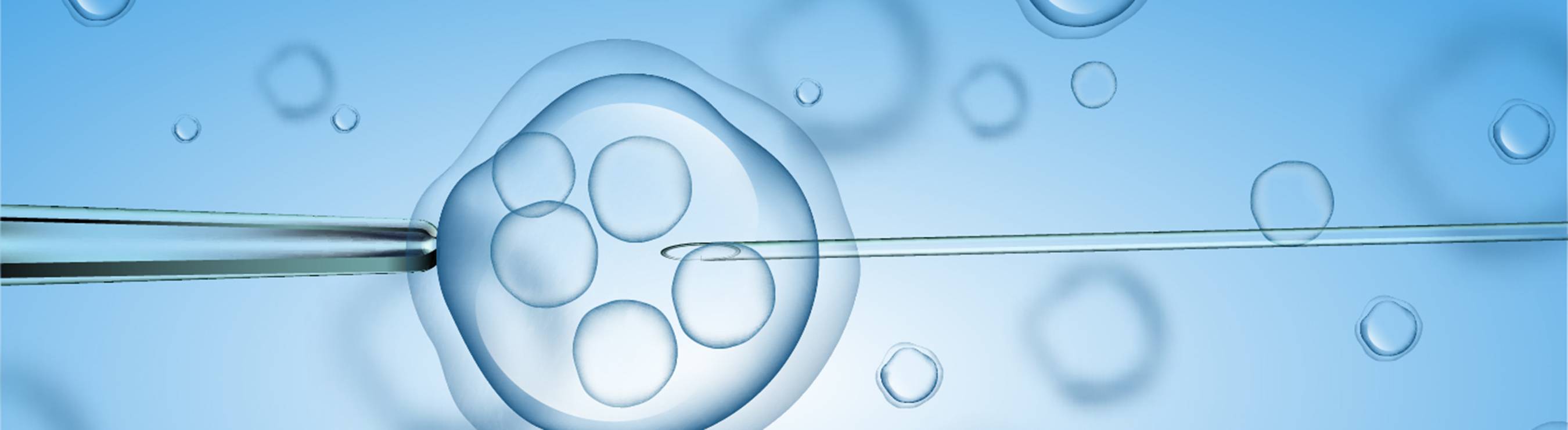

Conceiving Success: Growth and Consolidation in IVF in APAC and the Middle East

In-vitro fertilization in Asia-Pacific and the Middle East is growing quickly due to several factors; the industry’s rapid growth offers an opportunity for investors to capitalize on momentum. In a… Read More

Investors Seek Protection in the Safety Workwear Market

The safety workwear industry is a highly resilient and very attractive market that covers all personal protective equipment from head to toe, including helmets, goggles, gloves, shoes, protective clothing and… Read More