Growth & Venture Equity Valuations: OPM and CSE Considerations

| Every valuation cycle, deciding between valuing growth and venture equity using option pricing models (OPMs) and common stock equivalent (CSE) allocation methodologies is a point of tension between internal valuation teams, auditors, and the front office. Auditors question why OPMs are not being used and front offices struggle to understand how the OPM affects marks as opposed to the common stock equivalent or fully diluted (FD) analysis.

Lincoln’s Valuations & Opinions Group has been in the room for both reactions, and our valuations experts have extensive experience addressing the concerns of all parties. The central difficulty of the situation is applying the OPM and CSE in a manner that 1) is accepted by auditors / regulators and 2) has real world applicability to investment teams. Lincoln has experience regarding OPM and CSE considerations both as a third-party valuation firm and doing valuations in-house for leading investors. Based on cumulative centuries of experience, our valuation professionals have found the most practical solution for assessing methodologies when valuing growth equity. While each valuation decision must be made on a case-by-case basis, this article contains guidance that will help facilitate smoother audits (and limit vacant stares and indignation from deal teams). |

Summary

-

Lincoln International’s Valuations and Opinions Group experts share their guide on applying the OPM and CSE allocation methodologies to meet regulatory and investor expectations.

- Sign up to receive Lincoln's perspectives

Looking Back at Valuation Trends

From 2019 to 2021, deciding between OPMs and CSE allocation methodologies came to a head during the major run-up in private company valuations and multiples. This spike in valuations was particularly notable across the growth equity and venture capital space as abundant and cheap capital drove some overexuberance and elevated valuations.

At the time, OPMs would consistently undervalue virtually all securities in the capital stack. As evidence of the OPM providing impracticable results, many firms were buying junior preferred and common stock alongside large primary financing rounds at the same price as the primary offering. A standard OPM allocation methodology would place meaningfully different values across the securities in the preferred stack, while the aforementioned secondary purchases would imply the securities were worth the same price per share. This definitional undervaluing of junior securities contradicted market participant behavior and provided strong arguments against using an OPM.

Further, while mergers and acquisitions (M&A) outcomes can often be excellent for founders and shareholders alike, investment teams at the growth stage typically underwrite to an IPO where all shares typically convert to common. As such, at entry, the OPM would also not tie to the underwriting thesis given most preferred shares typically forcibly convert to common upon a qualifying IPO.

When the market began correcting in 2022, the use cases of the OPM grew in number. Frothy multiples at the peak of 2021 were almost always accompanied by similarly eye-popping growth, providing some justification for premium valuations. Once growth started to diminish, however, elevated multiples could no longer be justified, especially when paired with high cash burn lingering from the days of cheap capital. While not every company experienced the same level of performance degradation, it was clear that for many growth-stage businesses, valuations needed to decline from their 2021 peaks, placing a renewed focus on downside protections.

Liquidation preferences, participation rights, compounding dividends, return thresholds and more are put in place to provide downside protection. As valuations declined in 2022, many firms justifiably asked, “What about my preferential terms? Don’t I have some protection?” While an OPM tends to undervalue securities in a bull market, utilizing only a common stock equivalent or fully diluted allocation methodology in a bear market will undervalue all but the most junior preferred securities. Now, the question becomes how to balance the usage of the OPM and common stock equivalent analyses.

OPM and CSE Guidebook

|

1 |

The valuation should conclude on one equity value for the company, not solely based on a bottoms-up or “backsolve” approach. Instead, it should be built using fundamental analysis through some combination of the following (depending on the level of access to information): market approach, income approach, and precedent transaction / last round of financing. The equity value conclusion needs to be defensible in the context of public market comparable companies, the company’s current performance / projections, and comparable transactions (if available). In many instances, this value will be materially lower than the post-money valuation from the last round of financing depending on when the last round occurred. |

|

2 |

This fundamentally-derived value is then run through two allocation methodologies: an OPM and common stock equivalent. The outcomes from these two allocation methodologies are weighted, and the allocation framework is simple: what is the probability that this company will exit via M&A (OPM) or IPO (fully diluted)? Although subjective, the weighting should reflect the market participant’s arms-length view, so it will be incumbent on the valuation team to work in conjunction with the deal team to establish a baseline and develop a story used to support the allocation choices. |

|

3 |

Any changes quarter-over-quarter will need to be well-documented and anchored by current happenings at the company level and in capital markets more broadly. While the IPO market has begun to show signs of opening up, the vast majority of exits are still through M&A. |

For further data, please reference Lincoln’s Q2 2025 Venture Primer.

Simplified, Hypothetical Example

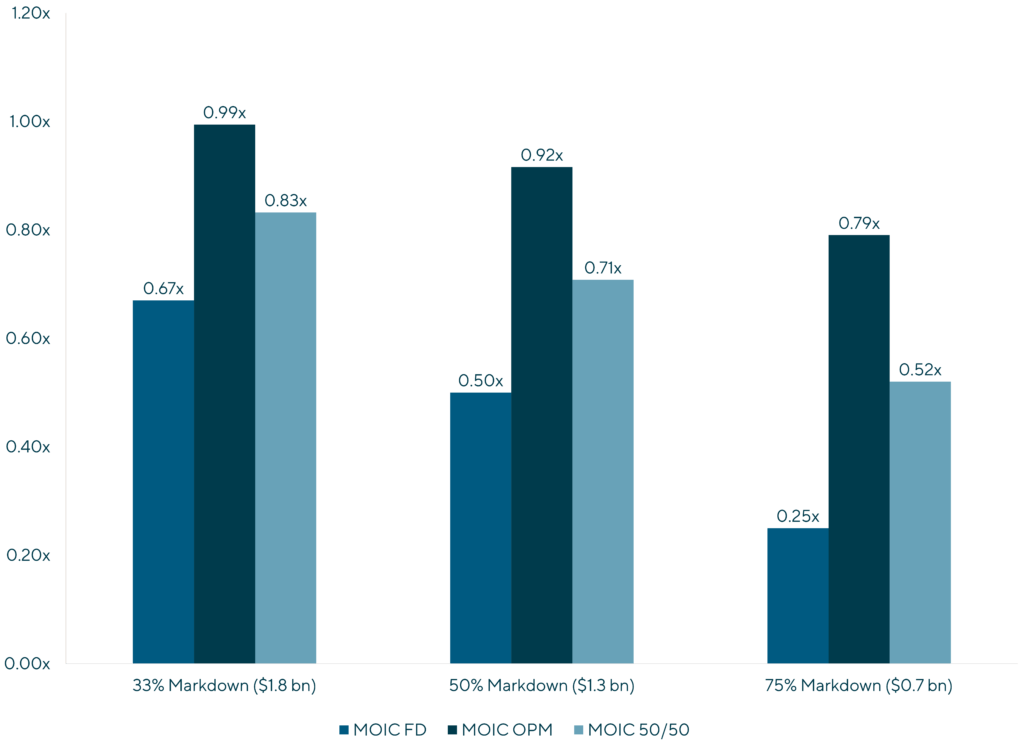

To understand the playbook above, suppose hypothetical Company A raised equity at a $2.7 billion post-money valuation at the peak of the market, where the hypothetical investor holds only the most recent preferred security (with standard terms like 1x pari passu liquidation preferences and no participation rights).

As illustrated, continuing to utilize only a fully diluted allocation methodology could understate the investment’s value. However, utilizing a blended approach reflects 1) a defensible equity value and 2) realistic exit scenarios (i.e. 50% chance of going public and 50% chance of getting acquired).

This approach works whether the market turns bearish or stays in a bull market. If the public market is active and liquidity is high, the OPM would be underweighted given the reduced likelihood of acquisitions dependent on liquidation preferences. There are many additional nuances to consider, and every case has its own facts and circumstances to be evaluated. However, in Lincoln’s experience, the framework above threads the needle by satisfying audit requirements while still being anchored in real-world transactions and expected outcomes for the portfolio companies.

Looking Ahead with LincolnWith a passion for delivering high-quality valuations, Lincoln’s Valuations & Opinions Group combines real-world experience with sophisticated expertise in all types of valuation methodologies. Our global team of 200+ dedicated valuations and opinions professionals help ensure sound decision-making and drive successful outcomes in today’s dynamic market. Our bankers are available to guide clients through the process outlined above, as well as any nuances that may arise in valuations. Contact our team today with any questions—we look forward to connecting. |

Contributors

Related Perspectives

in Valuations & Opinions