Powering Progress with GovTech

Mar 2025

| Lincoln International’s government technology (GovTech) market observations highlight the increasing preference of government agencies for integrated software solutions, driven by the need for efficiency, reliability, and coordination. There is significant growth potential in the GovTech market, fueled by cloud migration, federal support and strategic M&A activities, with valuations showing resilience and upward trends.

In this series, Lincoln International delves into the GovTech market, exploring its innovative solutions, trends, opportunities and positive impact on public sector operations. |

Summary

-

GovTech

- Lincoln International launches a GovTech series where our experts will explore the sector's trends and opportunities.

- Connect with a Senior Professional

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Volume Six: The Cloud Revolution

In the sixth volume of the GovTech series, Lincoln’s experts explore the transformative impact of cloud technology on government operations. This volume highlights the key tailwinds and growth drivers pushing government cloud adoption and investment.

Compelling Tailwinds Increasing Government Cloud Adoption and Spending

Growing government investment in cloud technology is being driven by a combination of internal and external forces.

Government’s Accelerating Investment in the Cloud

Federal and local government grants, subscriptions and investments in cloud technology are growing rapidly. Initiatives aimed at operational efficiency and an increased purchasing capacity are propelling this accelerating growth.

50%+ |

Over 50% of government IT leaders are developing cloud migration strategies for operational efficiency |

|---|---|

10%+ |

Cloud vendors for cities, counties and towns are experiencing 10%+ growth in SaaS subscriptions |

$500B+ |

Federal support for cloud technology is at an all-time high, with $500B+ allocated for state and local digital infrastructure |

$1B+ |

Grants of $1B+ awarded to state and local governments as part of the Build Back Better Regional Challenge, matched by $300M in private funding |

50% |

Substantial “rainy day funds” at local municipalities, reaching 50% of annual operating expenditures, indicating signifiant purchasing capacity |

Sources: Deloitte; Technology Business Research; NYS Office of the Controller; WhiteHouse.gov; Eda.gov

Cloud is Coming

Government agencies are increasingly adopting cloud solutions, with leaders driving adoption in areas like citizen engagement and HR. As legacy challenges and compliance hurdles ease, SaaS adoption is set to accelerate dramatically over the next decade.

| GovTech is at an inflection point on the cloud adoption curve, driven by cloud-first mandates, advanced SaaS solutions and rising citizen demands for digital services |

Volume Five: Multiple Areas to Realize Operating Leverage Throughout the P&L

The unique characteristics of the GovTech market underpin opportunities to create value across a GovTech vendor’s entire organization. Reference the key below to align with income statements.

|

|

|

Stable New Bookings | While sales cycles are long, lower ACVs associated with small local governments yield bookings stability |

|

|

Attractive Existing Customer Monetization | Stellar net retention due to customer propensity to buy multiple products, ability to extract price increases, payments adoption, cloud migration, etc. |

|

|

Sticky Customer Base | Slow and bureaucratic decision-making fosters high retention rates, as there is little incentive to switch technology providers once chosen |

|

|

Predictable Revenue Streams | High retention and recurring revenue percentages drive strong revenue visibility |

|

Low Cost to Support | Customer stickiness reduces support obligation |

|

Efficient GTM | Leverage shared incentives and collaboration across non-competing public sector clients to drive viral customer acquisition and seamless “land and expand” growth |

|

|

Minimal Demand for R&D Innovation | GovTech customers prioritize “good enough” solutions over “cutting edge” technology, with modest expectations and no need to evangelize established product categories |

|

Robust EBITDA Margins | The combination of top-line predictability and operating efficiency enables GovTech vendors to enjoy healthy and consistently expanding margins |

| GovTech vendor operating leverage has powered outstanding returns for the private equity community over the past decade+ and continues to attract tremendous interest. |

Volume Four: Prime Prospects: The High-Value GovTech Customer Base

In the fourth volume of this series, Lincoln explains why U.S. government agencies are attractive customers, making GovTech vendors particularly valuable to financial and strategic buyers alike.

Government Customers Have Highly Attractive Characteristics

The 90K+ government agencies in the U.S.(1) represent a highly attractive customer profile due to their long lifetimes, centralized decision-making, and collaboration on best IT practices.

Word of Mouth Heavily Influences Local Governments

How / Why Government Customers Drive Viral Adoption

|

|

|

|

| Alignment | Standardization | Risk Management |

| Unlike the commercial sector, government entities do not compete, so they share best practices. | The need for coordination between neighboring / overlapping encourages agencies to use common IT systems. | Governments tend to be more risk-averse than commercial customers, so they prefer vendors that are proven with peers. |

Implications for GovTech Vendors

|

Local GovTech is a Direct Sales Market | May require physical presence in key geographies to gain traction among clusters of prospects / customers. |

|---|---|---|

|

Leverage GovTech Communities | GovTech conferences are plentiful and valuable for building a brand in local government networks. |

|

Customer Success is Key | Critical to deliver on implementation / support to provide a positive experience that will enable viral adoption. |

| Capitalize on Collaboration | Emphasize customer testimonials / references / referrals wherever possible. | |

| Consider M&A to Enter New Markets | Can be much more efficient / actionable to enter a new market via acquisition of an existing vendor than to seek to establish a footprint from scratch. | |

|

Start Small | May be necessary to build a presence in a region via smaller customers to start before leveraging them to access larger customers. |

| GovTech vendors benefit from viral customer acquisition, resulting in a highly efficient GTM. |

Government Agencies Are Highly Retentive

Gross Dollar Retention from Lincoln’s Recent GovTech Transactions

Key Characteristics of GovTech Vendors Driving High Retention

| Slow / Bureaucratic Decision Making: Processes for approving new software can be lengthy and complex. |

| Long-Term Contracts: Most federal agencies opt for long-term vendor agreements. |

| User Training / Familiarity: Government employees are relatively averse to change, feeding preference for existing systems |

| High Switching Costs: Changing systems involves significant time, effort, and financial resources. |

| GovTech vendors benefit from high customer stickiness, yielding highly profitable customer lifetime values due to long tenures and diminished support / R&D obligations |

Source:

(1) 90K+ government agencies consists of federal agencies, state governments, municipalities, counties, school districts and other special purpose local governments. Figures sourced from USA.gov, US Census and the St. Louis Federal Reserve

Government Agencies Present a Highly Attractive Cross-Sell Opportunity

Government decision-makers are increasingly pushing toward standardizing on one vendor platform across jurisdictions, departments, agencies, etc. providing the opportunity for a full-suite software vendor to capture significant market share.

Cross-Sell Yields Highly Attractive Unit Economics…

Illustrative Customer Journey for a Government Agency

|

1 |

Agency identifies core need and chooses vendor through word-of-mouth research and careful vetting process. |

|

2 |

Over time, agency naturally finds need to expand number of seats and adopt cloud technology. |

|

3 |

Agency discovers additional needs; contemplates existing vendors due to built-in trust, implementation speed, and likelihood of budgetary approval. |

|

4 |

Agency consolidates workflow software and payments to fully integrate technology stack and improve transparency of revenue reporting. |

|

5 |

Fully penetrated spend, capturing all whitespace and maximizing customer-level profitability. |

| GovTech customers who start small at sign-on can be highly economically valuable / profitable over time. |

…and Efficient Go-to-Market Strategies

S&M Efficiency Statistics from Recent Lincoln GovTech Transactions

| Government agencies preference for one platform makes purchasing from an existing vendor favorable, faster and much easier, driving a fertile cross-sell strategy and highly attractive unit economics. |

Sources:

(1) LTM Recurring Revenue Bookings / LTM S&M Expense

(2) Lifetime Value / Customer Acquisition Cost

(3) Average Recurring Revenue Contract Value for 1 Year

Volume Three: Booming GovTech Valuations

In volume three of our series, we explore how rising private equity interest has driven GovTech valuations and M&A activity to new heights.

Expanding GovTech Multiples

Recent transactions have showcased that acquirers have an appetite for the GovTech category and are willing to pay a premium for these assets, accelerating M&A activity and fueling valuations.

Precedent Transaction Median EV / EBITDA Multiples(1)

GovTech’s performance is consistent across periods and with that of broader SaaS vendors, implying recent premium is driven by market demand rather than a superior financial profile.

|

Precedent Transaction Median LTM Revenue Growth(1)

|

Precedent Transaction Median EBITDA Margin(1) |

Public Markets Mirror Private Market Demand for GovTech Across Economic Cycles

GovTech has outperformed both the S&P 500 and the more traditionally tech-heavy NASDAQ over the past five years, showing resiliency over the last 24 months as other market valuations have contracted. Public markets resemble the private markets in showcasing the value investors place on GovTech assets.

Public GovTech Index – 5-Year Trading Performance(1)(3)

Public GovTech Index – 3-Year EV / NTM EBITDA Trending (1)(3)

|

|

Why are GovTech Valuations Attractive?

Investors find GovTech valuations desirable for the following reasons:

| Dependability of the Customer Base |

|

|

| Sustainability & Predictability of Growth |

|

|

| Significant Market Tailwinds |

|

|

| Attractive Customer Preferences |

|

|

| Operating Leverage Throughout the P&L |

|

Sources:

(1) Lincoln Proprietary GovTech Precedent Transaction Database; Lincoln Proprietary SaaS Precedent Transaction Database

(2) CapIQ as of September 26, 2024

(3) GovTech Index comprised of Axon Enterprises, Cellebrite, Constellation Software, Euna Solutions (fka GTY Holdings), Motorola Solutions, Roper Technologies, SoundThinking (fka Shotspotter) and Tyler Technologies

Volume Two: Trends Driving GovTech

In the second volume of the GovTech series, Lincoln’s experts explain how the sector represents a large, underserved market in the software industry with significant growth drivers fueling adoption and spending.

GovTech is a Large and Growing Market Ripe for Disruption

The public sector represents one of the most well-funded, yet underpenetrated, markets in software. This can be attributed to outdated systems, bureaucratic hurdles, long procurement cycles and resistance to change. The GovTech market is highly fragmented, with few providers of scale, and plenty of whitespace for innovators to capture significant market share. Further, multiple tailwinds continue to accelerate spend in new solutions, yielding a significant opportunity for vendors, acquirers and private equity (PE) firms.

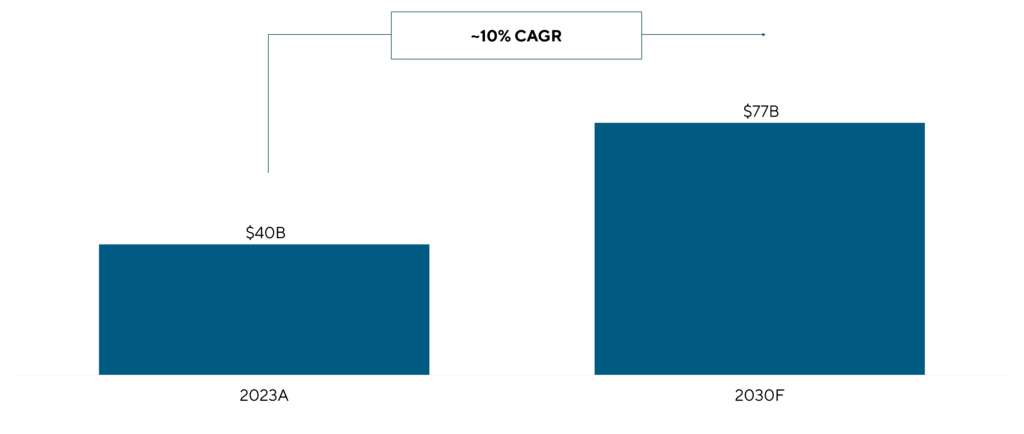

Forecasted Global Government Software Market Size1

Government’s Accelerating Investment in the Cloud2

GovTech is an expansive market early in the software adoption curve with multiple trends driving continued growth in the near term.

~80% |

Approximately 80% of on-prem ERP adopters are likely to migrate to a cloud-based solution in the next three to five years. |

|---|---|

50%+ |

Over 50% of government IT leaders are developing cloud migration strategies for operational efficiency. |

10%+ |

Cloud vendors for cities, counties and towns are experiencing 10%+ growth in Software-as-a-Service subscriptions. |

$500B+

|

Federal support for cloud technology is at an all-time high, with $500 billion+ allocated for state and local digital infrastructure. |

$1B+ |

Grants totaling $1 billion+ awarded to state and local governments to provide technical assistance & support to regional communities as part of the Build Back Better Regional Challenge, matched by $300 million in private funding. |

50% |

Some localities now have substantial “rainy day funds,” reaching up to 50% of annual operating expenditures, indicating significant purchasing capacity. |

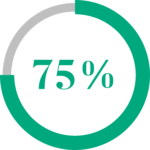

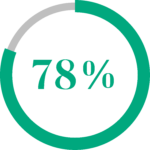

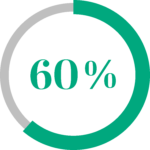

Predictions for the GovTech Market3

|

|

|

|

| By 2025, 75% of governments will expand the adoption of cloud solutions to 50%+ of total spend. | By 2026, 78%+ of government CIOs will increase investments to produce positive citizen experiences as a critical business outcome. | By 2026, 60%+ of government organizations will prioritize investing in business process automation, up from 35% in 2022. |

GovTech Has Compelling Tailwinds Increasing Adoption and Spend

Strong market forces and strategic initiatives are propelling GovTech cloud adoption and investment.

Intensifying Demand for Purpose-Built Solutions

| Under-digitization in local governments drives the need for modern cloud-native solutions.

50% of local governments still rely on outdated or homegrown systems, representing a ~$20 billion market segment that requires modernization to enhance efficiency and provide purpose-built functionality |

| Federal stimulus money (e.g., ARPA) supports stable budgets for local governments.

Massive amounts of funding are contributing to local government’s continued digitalization movement. |

| Desire for increased transparency and efficiency resulting in the adoption of purpose-built software.

Public sector employees are demanding better efficiency and transparency, while citizens are seeking increased visibility into government operations, spending and revenue. |

| Labor shortages fueled by an aging workforce are incentivizing governments to leverage software to increase efficiency and productivity.

Government agencies are constantly looking for new ways of doing more with less amidst challenging labor markets. |

| COVID-19 and cyber threats drive governments toward secure, cloud-based solutions.

The shift to work-from-home due to COVID-19 and the increased threat of cyber-attacks are compelling governments to adopt fast, secure and effective cloud-based solutions. |

| Demand by citizens for modern, accessible and resilient solutions is accelerating.

Consumer expectations for easy-to-use, digital-first solutions have extended to all facets of daily life, including paying bills and accessing public resources. |

Sources:

(1) Verified Market Reports; includes spend related to the creation, application, and upkeep of software solutions specifically designed to satisfy the particular requirements and needs of governmental bodies at all levels, including local, state and federal governments

(2) Gartner

(3) Deloitte; Technology Business Research; NYS Office of the Controller; WhiteHouse.gov; Eda.gov

Volume One: Integrated Solutions

In the first volume of this series, our experts explore why government agencies prefer integrated solutions as well as value-creation opportunities for vendors, acquirers and private equity (PE) firms.

Government Agencies Prefer Integrated Solutions

Government decision-makers are pushing toward consolidating their technology needs across jurisdictions, departments and agencies, providing an excellent opportunity for a full-suite government software player to capture significant market share.

Government agencies rely on a myriad of systems to facilitate daily operations. Each of these systems can be sold as standalone point solutions, but many government agencies prefer to consume them from a single, consolidated vendor.

Below is a look at an illustrative government agency tech stack. These systems monitor the back-office details for revenue-generating segments and can integrate with payment processing solutions to enable real-time reconciliation and increased data accuracy.

|

Benefits of an Integrated Platform

Government agencies’ preference for one platform makes purchasing from an existing vendor favorable, faster, and much easier, driving a fertile cross-sell strategy.

| Ease of Use: By providing one centralized portal for all back-office functionality, integrated platforms reduce the potential for user errors, simplify training and decrease the investment required for support / maintenance. |

| Efficiency: Agencies are often resource-constrained, especially when it comes to IT personnel / budgets. Using one vendor simplifies procurement, maintenance, training, integration, etc. and reduces the total cost of ownership. |

| Power of Integrated Apps: Real-time reconciliation across applications provides a better customer experience, reducing / eliminating highly manual / time-intensive reconciliation processes and increasing data accuracy across all functions. |

| Common Buying Center: The selection process for small government agencies is centralized around a single decision-maker, reducing the need for interdepartmental buy-in (e.g., budgetary, compliance, trust) when acquiring additional solutions. |

Massive Value Creation Opportunity for GovTech Vendors, Strategic Acquirers and PE Firms

The potential for value creation driven by cross-selling, mergers and acquisitions (M&A) and organic growth is massive, proven and highly actionable as the industry is in the early innings of digitization and software adoption.

| Cross-Selling Prospects: A natural cross-sell opportunity exists for any vendor that has multiple solutions, given customer preferences for an integrated platform. |

| Opportunity for Accretive M&A: Because cross-sell drives revenue synergies on top of cost synergies, more M&A targets are likely to be accretive. |

| Higher Retention Profiles: Customers who purchase multiple solutions from the same vendor tend to be stickier than those who purchase one solution. |

| Attractive Unit Economics: The cost of acquisition for smaller annual contract value customers can be more economically viable for Software-as-a-Service vendors because cross-selling of additional solutions can make them more profitable over time. |

What is the Opportunity for Vendors, Strategic Acquirers and PE Firms?

The attractive buying behavior of government agencies makes this a market particularly ripe for value creation via cross-selling, accretive M&A and organic growth.

| Factor Customer Preference into Valuation: For add-ons, feel more comfortable underwriting revenue synergies. For platforms, consider how add-ons can be more accretive than in commercial end markets. |

| Prioritize Growth Strategies Accordingly: Pursue add-on M&A more aggressively. Payments have proven to be a particularly successful cross-sell / growth opportunity. |

| Building vs. Buying: Consider creating instead of acquiring a product suite. As local government is less digitized, they have fewer product requirements. New product development efforts may not be so costly or long. |

| Avoid Common Pitfalls: Integrate products to reduce the burden on customers. Focus on the ideal customer profile / buying center as cross-selling is more successful when to the same buyer / type of customer. |

Contributors

Connect with a Senior Professional