Untangling Hair Care’s Growth and Acquisition Trends

| The global hair care market continues to be marked by strong recurring demand, high margin potential, category premiumization and ongoing innovation, leading to optimism about the sector’s future. Ashleigh Barker, Director and head of beauty and personal care, shared her perspectives on the state of the hair care market alongside the top founders, investors and industry executives at Beauty Independent’s 2025 Dealmaker Summit conference in New York. For hair care brands navigating the tumult of 2025, it is crucial to target the increasing consumer demand for useful, purpose-driven products customized to specific needs and solutions and capitalize on the high consumption rates.

Lincoln’s team of dedicated consumer bankers are empowered by proprietary index data and deep insights into sector trends, uniquely positioning the team to support strategic growth investments and acquisitions in beauty and personal care. Whether hair care brands are looking for value-add investors to help accelerate growth, preparing for a strategic exit or a sponsor is seeking to drive growth in a portfolio brand, Lincoln’s team is equipped to provide exceptional transaction outcomes. Read on to learn more of Lincoln’s insights and strategies for hair care in 2025 and beyond. |

Summary

-

Lincoln International’s beauty and personal care experts share insights into the growth and acquisition trends of the hair care sector.

- Click here to download a printable version of this report.

- Sign up to receive Lincoln's perspectives

Is the Hair Category Growing?

Despite slowdowns across the broader beauty and personal care industry, the global hair care market remains in “growth mode.” Ample white space remains for brands looking to expand market share, either through customer acquisition, product portfolio expansion or new channels of distribution.

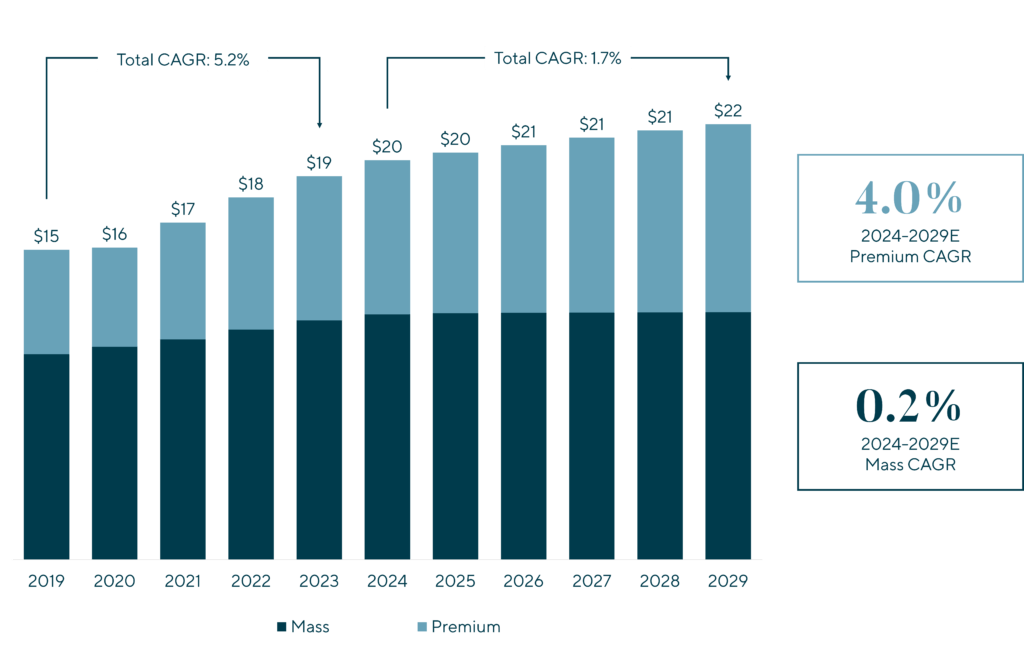

In North America, the majority of hair care’s growth comes from the premium segment which continues to outpace the mass market. From 2023 to 2029E, the premium hair care segment is projected to grow at a CAGR more than 4 times that of mass hair care, a channel that otherwise globally dominates the category, dwarfing both premium and professional segments.

Evolution of the North American Hair Care Market (2019 – 2029E)

Estimated Global Revenue of the Hair Care Industry ($ in billions)

For earlier-stage brands, 2025 presents an ideal opportunity to capture areas of growth and justify their shelf space by defining the brand to consumers and focusing on the core value attributes that differentiate the brand amid an ever-growing market. Over the next 12-18 months, brands that are able to capture growth and harness trends that drive customer loyalty will be primed for a strategic exit down the line. Profitability will continue to be a primary focus of investors and acquirers, and it should similarly drive a brand’s strategic decision-making process when executing on their growth strategies.

While the financial thresholds a brand must achieve will differ from one buyer to the next, demonstrating clear proof of concept, reason to be on the shelf and double-digit profit margins (or a clear path to achieving this) will lead to increased investor appetite. The coming quarters represent a window of opportunity for brands to focus on building a strong foundation to establish these pillars of opportunity.

Five Trends Driving Growth

As brands define themselves and grow in market share, capturing customers will require establishing a clear point of differentiation and value proposition in the eyes of consumers. Individual brands and products do not need to serve every consumer niche, but to secure a loyal spot on bathroom and shower shelves, products must deliver on promised benefits and cater to consumers’ individual needs. Five specific trends are driving demand and innovation in hair care, creating disruption for brands to capitalize on.

Professional-Backed Brands Induce Confidence and Drive Sales

Professional stylists are the ultimate authority when it comes to understanding how consumers should care for their hair, leading many to launch their own brands full of proprietary performance-enhancing ingredients that create clear points of differentiation for their brands versus peers that share the same shelf space. The founders of these brands serve as both the authority in their field, instilling consumer confidence in the product from the start, as well as providing an added proof point and “reason to be on shelf” with the help of established awareness that may otherwise take an unknown brand years to develop on its own. In a survey conducted by Salon Today, 50% of respondents said their product purchases were influenced by a stylist’s professional recommendation, creating a clear whitespace opportunity for more professionally backed brands that come with established credibility and awareness.

Adoption and Demand for Premium Products

The revenue share from premium hair care products in North America (versus mass hair products) increased by ~500 bps from 2019 to 2024 reaching 39% of the total category share. Consumers have clearly demonstrated their willingness to invest in high-quality, sometimes salon-inspired formulas, ultimately backed by real, clinical science and proven efficacy of formulations that can deliver enhanced results.

However, one can’t ignore the fact that the majority of Americans are shopping in mass channels such as Target and Walmart, and these consumers also demand the same results and efficacy from their hair care products as their more affluent counterparts. This has spurred increased innovation from mass brands, which are now offering better ingredients and promising solutions equivalent to premium products. The level of innovation in brand offerings and formulations has also resulted in consumers utilizing both high-cost and affordable options in their hair routines, similar to the fashion trend of consumers pairing high-end designer items and lower cost alternatives.

Brands positioned within the masstige category will also find a growing demographic of customers looking for high-quality, efficacious ingredients that deliver salon-quality results at home, all at an attractive and accessible price point, especially as current macroeconomic conditions have led many consumers to tighten their purse strings.

The Hottest Demographic

Gen Z and Gen Alpha have meaningful spending power and influence as consumers, and Gen Z consumers in 2025 have so far spent 10%+ more on beauty products versus 2024. As a whole, the generation is the fastest-growing market segment and inclined toward bold, expressive and unique products.

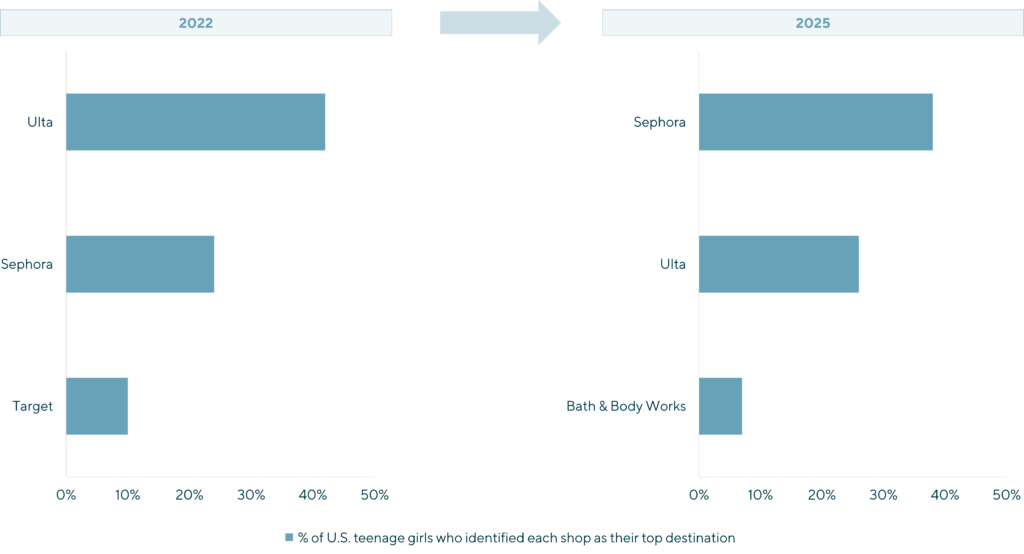

In 2023, Sephora overtook Ulta as the number-one beauty shopping destination for teenage girls in the U.S., offering viral products and targeted marketing campaigns. Despite the trendiness of Sephora, more accessible channels (e.g., Ulta, drug stores) are still growing and appealing to younger shoppers seeking brands that spark buzz on social media and still fall within their budget.

Leading Beauty Shopping Destinations Among Teenagers in the United States

No matter the channel or segment, brands who successfully appeal to Gen Z will attract a captive audience for the coming years.

“Skinification” of Hair Care

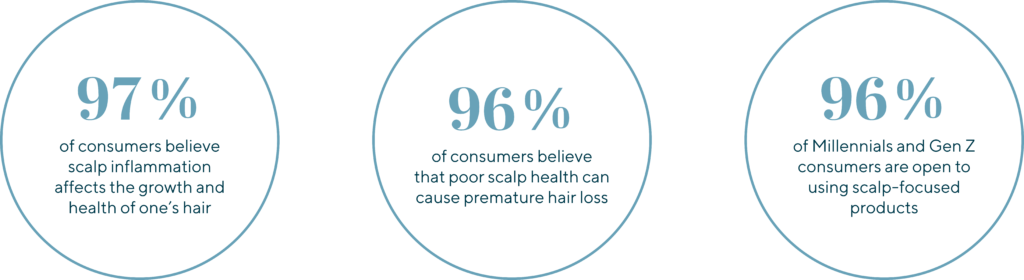

The health of one’s hair starts at the scalp, and a healthy scalp is crucial for maintaining healthy hair. Consumers are more aware of the pivotal role scalp health plays in overall hair health: stronger hair at the root, lessened frizz and increased hair growth all drive demand for specialized scalp care products. Recent trends in scalp care, particularly given the increase in cases of hair loss and hair thinning among younger consumers, demonstrate a shift towards products that specifically target scalp concerns, including dryness, oiliness, sensitivity and overall microbiome care, a sub-trend which is now taking center stage by focusing on balancing microbial diversity and promoting a healthy hair growth foundation.

The integration of diagnostic tools used to assess scalp health and provide personalized recommendations for tailored products allows brands to offer solutions that are precisely aligned with individual scalp conditions and preferences, enhancing the efficacy and satisfaction of consumers.

Serving Multi-Cultural and Textured Hair Needs

In North America, textured hair care represents 35% of the total haircare market, and, according to Mintel, the specific multicultural hair care market was estimated to be a ~$3 billion category as of 2023, projected to reach over $4.5 billion by 2032 (+4.3% CAGR), creating a large addressable market for targeted hair care needs.

Just as scalp and hair re-growth products have experienced significant momentum and innovation through the “skinification” trend, brands are increasingly working to meet the specialized needs of both multi-cultural consumers and consumers more generally who have curly, wavy and textured hair through investments in innovation. In some cases, brands have begun focusing exclusively on styling products (e.g., curling agents, smoothing and hydrating serums, heat protectants), which as a category, is also undergoing rapid acceleration and makes up approximately 15% of the broader North American hair care market.

For brands meeting the needs of different hair textures and cultural backgrounds, the trend driving growth of the category follows a consistent theme: you don’t need to do everything for everyone—just have a clear value proposition and deliver on your promise to consumers through authentic engagement, results and efficacy.

Looking ahead with LincolnAs the mergers and acquisitions market for beauty and personal care begins to pick up, hair care remains positioned as an attractive sector for investment among both private equity and strategic buyers. The next 12-24 months will provide an opportunity for earlier stage emerging brands to focus on improving profitability, operational efficiencies and achieving scale through customer capture and differentiation. Lincoln’s consumer expertise positions our team of dedicated bankers to support brands navigating market turbulence, identifying opportunities for growth and preparing for strategic exits as demand quickly rebounds. Reach out today to see how Lincoln can help your team and portfolio. |

Contributors

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-head of Consumer

Los Angeles

With a commitment to building lasting relationships, I take a bespoke approach to the individual needs of every client I work with, seeking to be their champion, trusted advisor and partner well before, leading up to and throughout any potential transaction that may take place.

Ashleigh Barker

Director

Los AngelesRelated Perspectives

in Consumer